Financial clarity that powers confident business decisions

Your Financial Status Is Our Goal

Expert financial management and strategic advice

About Us

AIMS FINANCE SERVICES LTD is Our Financial Management service blends consultancy and hands-on financial oversight

Why Choosing Us!

Clients need stability and accuracy in financial reporting and advice

“Dependable service and consistent results you can count on.”

Clients want assurance that their business and personal financial matters are treated with absolute confidentiality.

“We respect your privacy — every discussion and document remains fully confidential.”

We build long-term partnerships founded on trust, transparency, and proven results.

Our systems and processes are built with advanced security protocols

Our professional approach ensures precision, transparency, and excellence in every project

Financial Management Services

Strategic financial planning is the foundation of long-term success.

It involves analyzing your financial position, defining clear goals, and creating a structured roadmap to achieve sustainable growth.

Through proactive planning and data-driven insights, businesses can allocate resources effectively, manage risks, and seize new opportunities with confidence.

We assess each investment with a clear, unbiased lens, analyzing market trends,

risk factors, and

strategic fit to identify the most promising opportunities.

Our ROI models forecast potential returns, helping you understand the expected performance,

payback periods, and value creation of every investment decision.

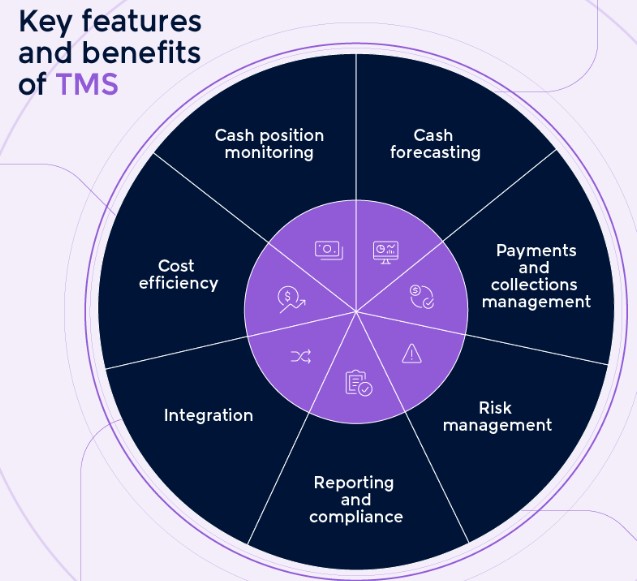

We forecast cash inflows and outflows to anticipate financial needs and avoid surprises.

Our strategies optimize working capital, ensuring resources are efficiently allocated across operations

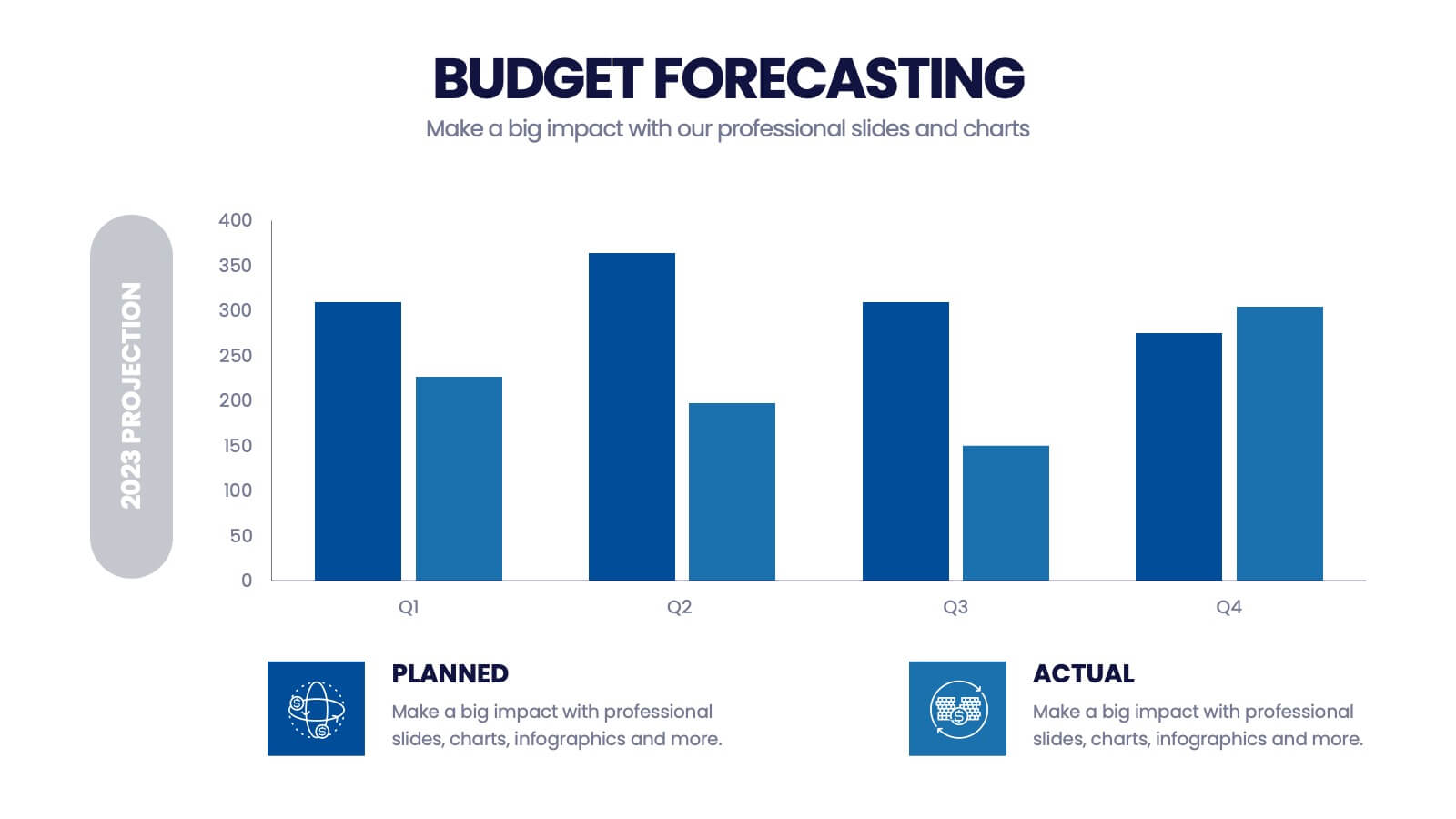

Create achievable budgets rather than overly optimistic or conservative targets.

Ensure forecasts remain relevant and responsive to changing market conditions

Identify deviations, understand root causes, and correct course proactively.

Provide management with a clear picture of performance to support informed decision-making.

Help management understand what drives performance and where interventions are needed.

Ensure managers receive information promptly to take corrective actions.

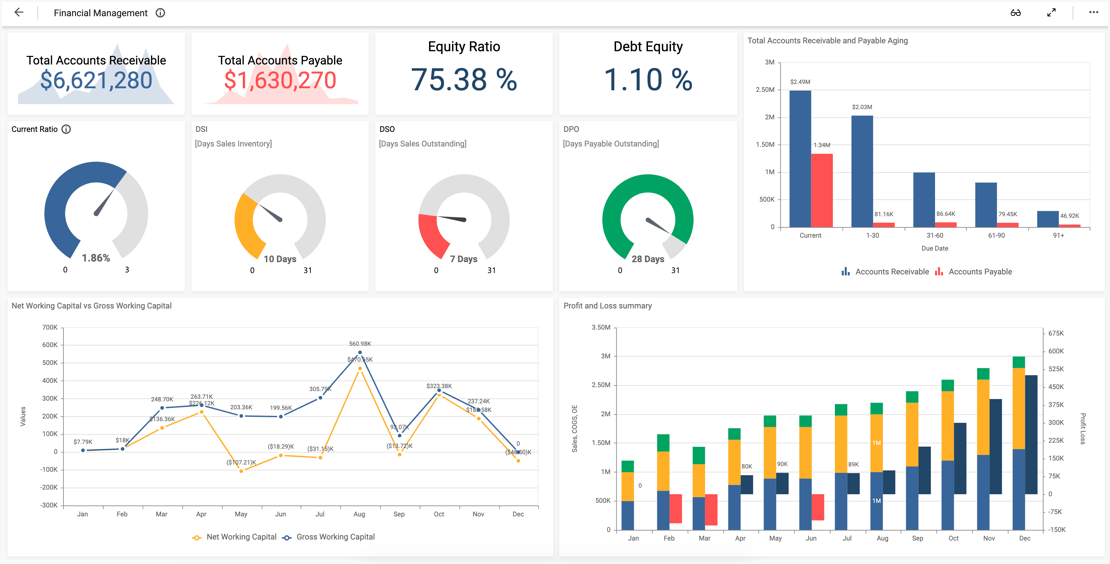

Financial reporting and analysis provide timely management reports, KPIs, and dashboards that enable leaders to monitor performance, make informed decisions, and drive business success.

Understand where the organization is exposed and prioritize risks by likelihood and impact.

Ensure consistent and effective management of risks across the organization.

Ensure all activities comply with laws, regulations, and

industry standards Risk management and compliance

focus on identifying exposures, designing effective

policies, and aligning operations with regulatory

requirements to protect the organization and ensure sustainable performance.

Lower operating costs without compromising quality or productivity,

boost gross and operating margins for sustainable profitability.

Improve financial flexibility, reduce financing costs, and support growth initiatives.

Business restructuring and optimization aim to

improve cost efficiency, enhance margins and

strengthen capital structure, driving sustainable

performance and long-term value creation.

Contact